📊 Basics of a Candlestick

Each candlestick represents price movement over a certain period (e.g., 1 minute, 1 hour, 1 day):

- Open: Price at the beginning of the time period

- Close: Price at the end of the time period

- High: Highest price during the time period

- Low: Lowest price during the time period

- Body: The range between open and close

- Wicks (Shadows): Lines above and below the body showing the high and low

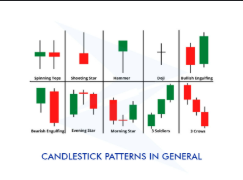

🔍 Common Candlestick Patterns in Forex

🟩 Bullish Reversal Patterns (Price might go up)

| Pattern | Description |

|---|

| Hammer | Small body, long lower wick, occurs after a downtrend |

| Bullish Engulfing | Large bullish candle engulfs the previous bearish candle |

| Morning Star | Three candles: bearish → small indecision → strong bullish |

| Piercing Line | Bullish candle opens below and closes above the midpoint of previous bearish candle |

🟥 Bearish Reversal Patterns (Price might go down)

| Pattern | Description |

|---|

| Shooting Star | Small body, long upper wick, occurs after an uptrend |

| Bearish Engulfing | Large bearish candle engulfs the previous bullish candle |

| Evening Star | Three candles: bullish → small indecision → strong bearish |

| Dark Cloud Cover | Bearish candle opens above and closes below midpoint of previous bullish candle |

⚖️ Continuation Patterns (Trend might continue)

| Pattern | Description |

|---|

| Doji | Open and close are nearly the same; shows indecision |

| Spinning Top | Small body with long wicks; also signals indecision |

| Rising Three Methods | Small bearish candles inside two large bullish ones |

| Falling Three Methods | Small bullish candles inside two large bearish ones |

✅ How to Use Candlestick Patterns

- Context is key: Always look at the trend and support/resistance zones.

- Confirmation: Wait for confirmation before entering a trade (e.g., volume, next candle).

- Combine with other tools: Use indicators like RSI, Moving Averages, or Fibonacci.

- Risk management: Patterns are not 100% accurate — always use stop-losses.